Über uns

Verantwortungsvolles Anlegen

Wir sind überzeugt, dass dies von wesentlicher Bedeutung für einen langfristigen Vermögensaufbau ist, der von intensivem Research, aktivem Aktionärstum und ständiger Weiterentwicklung getragen wird.

Überzeugende Kompetenzen

Aktives Aktionärstum

Produktlösungen

Gestalten des Marktes

Über 45

ESG-spezialisten

Über 250

Researchanalysten

40 JAHRE

erfahrung mit verantwortungsvollem anlegen

Ein globales Kompetenzzentrum

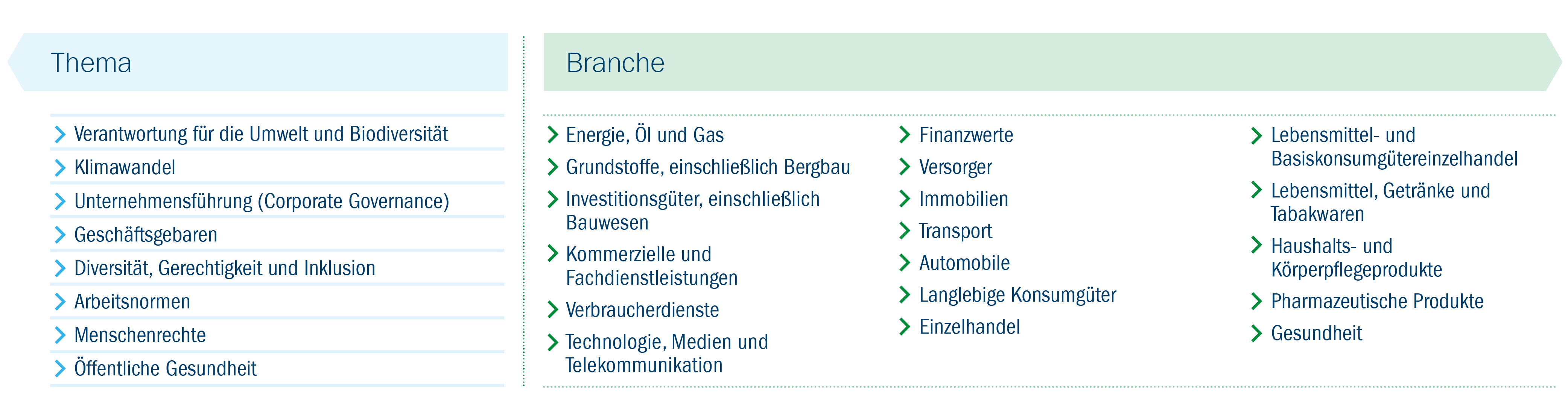

Breite Sektor- und Branchenabdeckung

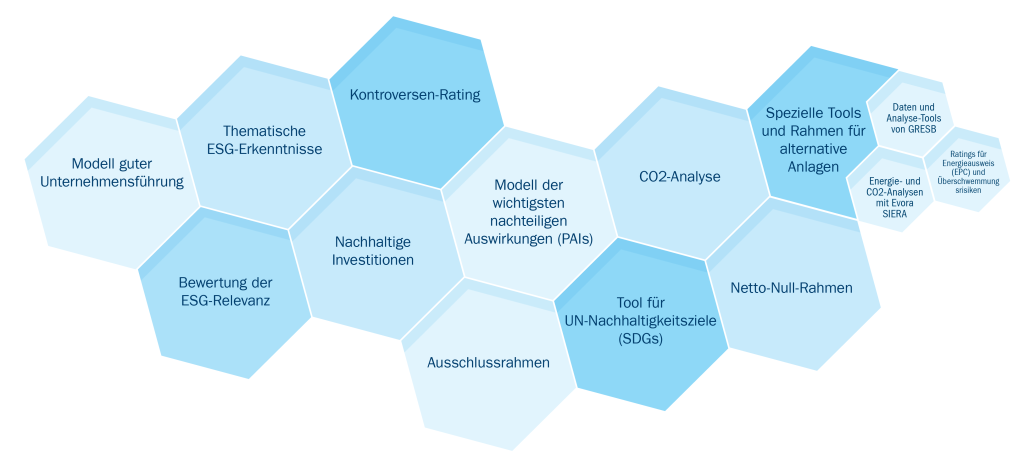

Tools und Rahmenbedingungen für das Research

Das Ausmaß, in dem diese Tools genutzt werden, hängt vom Mandat des Kunden und von den Zielen der jeweiligen Strategie ab.

Proaktive Mitwirkung und Stimmrechtsvertretung, um den Wert für Anleger zu maximieren

Fokus auf Vertrauensbildung

Unser primärer Ansatz bei der Mitwirkung besteht im Führen konstruktiver und vertraulicher Dialoge. Dabei handeln wir in der Regel allein und suchen die Interaktion mit wichtigen Entscheidungsträgern. Als langfristig orientierte Anleger schätzen wir Beziehungen, die auf Vertrauen basieren.

Wir setzen uns auch mit anderen Anlegern, Nichtregierungsorganisationen (NGOs) oder Branchenverbänden auseinander, wenn dies aus unserer Sicht im besten langfristigen wirtschaftlichen Interesse unserer Kunden ist.

Positive Veränderungen durch Stimmrechtsvertretung

Wir nutzen die Stimmrechtsvertretung, um Fortschritte und Verbesserungen durch die Emittenten bei zentralen ESG-Themen zu fördern und zu Verfahrensweisen guter Unternehmensführung und Risikominderung anzuregen. Wir halten dies für ein effizientes Instrument, um die Interessen unserer Kunden zu vertreten und um sicherzustellen, dass Emittenten unsere Anliegen und Wünsche nicht nur anhören, sondern auch entsprechend danach handeln.

Förderung konkreter Ergebnisse

Wir setzen im Rahmen unserer Mitwirkung klare umsetzbare Ziele, mit denen wir Wert für Anleger veranschaulichen können.

Unser aktives Aktionärstum betrifft ein breites Spektrum von ESG-Risiken und -Chancen und deckt Emittenten aus den unterschiedlichsten Sektoren und Regionen ab.

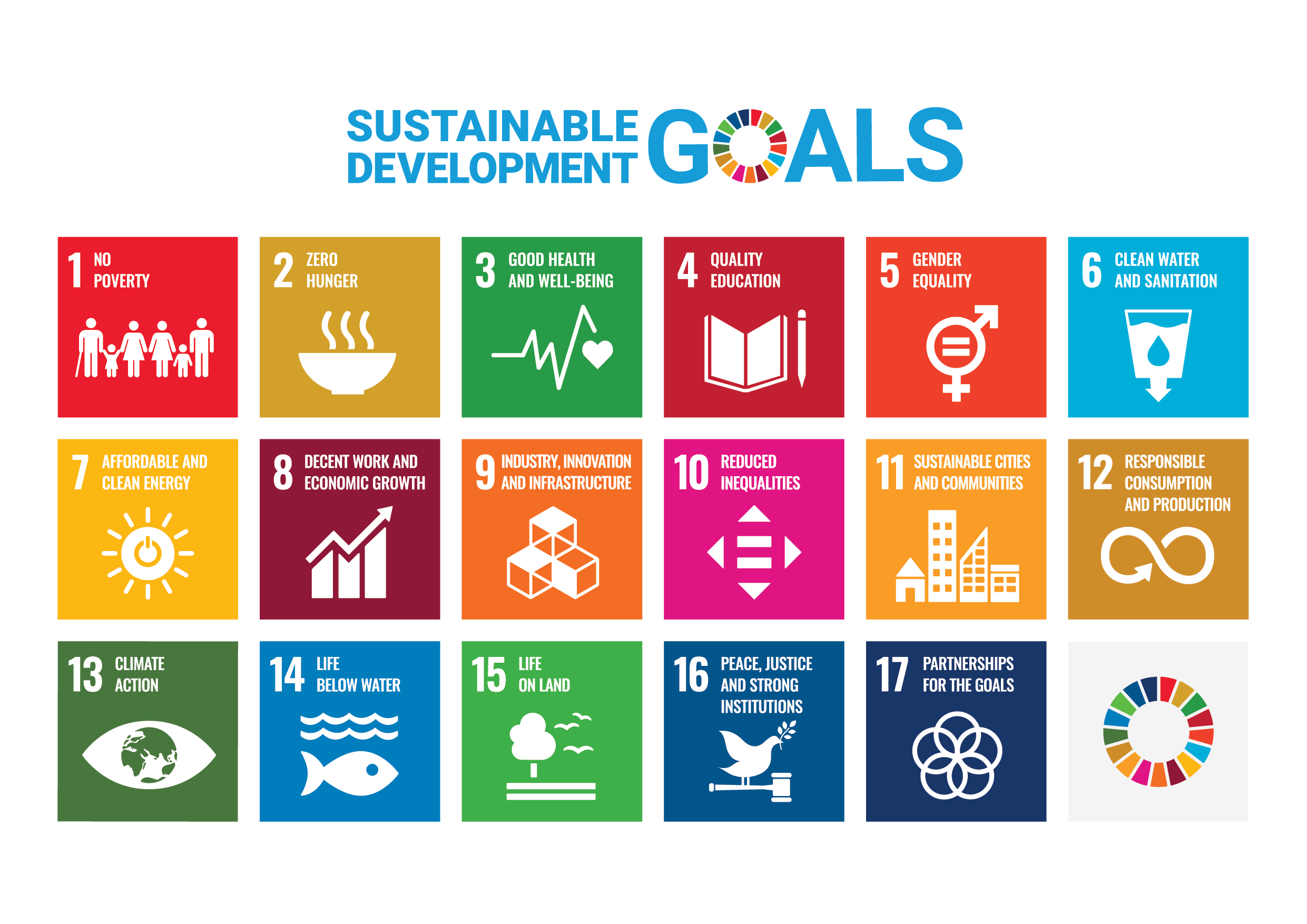

Wir strukturieren unsere Mitwirkung anhand von sieben übergeordneten Themen, die auf die 17 Ziele für nachhaltige Entwicklung der Vereinten Nationen und deren Teilziele ausgerichtet sind.

Strategien für verantwortungsvolles Anlegen

(reo®) – Unser Responsible Engagement Overlay Service

Wir waren Vorreiter beim aktiven Aktionärstum mit der Schaffung unseres Responsible Engagement Overlay (reo®) Service im Jahr 2000, über den unsere Kunden uns die Mitwirkung und Abstimmung in ihrem Namen übertagen. reo® bietet Kunden Zugang zur gesamten Bandbreite unserer Kompetenzen im Bereich Stewardship:

Weltweite Stewardship und Rechenschaftspflicht

Teil eines großen Austausches

Sinnvoll handeln

Unterzeichner der Stewardship Codes des Vereinigten Königreichs, Taiwans, Japans und Koreas

Gründungsunterzeichner der Prinzipien der Vereinten Nationen für verantwortliches Investieren (PRI)

- Unterzeichner der Initiative Net Zero Asset Managers

- Mitglied von Climate Action 100+

- Mitglied der Investor Alliance zur Unterstützung der Einhaltung der Menschenrechte

- Unterzeichner der Investor Stewardship Group in den USA, die sich aus Anlegern und Vermögensverwaltern zusammensetzt, die gute Praktiken bei Stewardship und Corporate Governance fördern

- Gründungsunterzeichner der UK Women in Finance Charter

Policies

Disclosures

A

Adverse impact

Aggregate sustainability risk exposure

The overall sustainability risk faced by a company or portfolio, taking account of a range of issues such as climate risk and ESG factors.

B

Best-in-class

Best-in-class strategies try to make their portfolios better on ESG issues and/or carbon characteristics by excluding certain investments deemed negative in that respect or including certain investments deemed positive in that respect.

C

Carbon footprint

The carbon emissions and carbon intensity of a portfolio, compared with its investment universe (benchmark). The benchmark might be, for example, companies in the FTSE 100.

Carbon intensity

A company’s carbon emissions, relative to the size of the business. This allows investors to compare the company’s carbon efficiency with its competitors‘.

Climate risk

The risk that an investment’s value could be harmed by climate issues such as global warming, energy transition and climate regulation. Investors normally assess climate risk by looking at carbon footprint data, climate adaptation risk, physical risk and stranded assets.

Climate adaptation risk

See Transition Risk.

Controversies

A company’s operational failures or everyday practices that have severe consequences for workers, customers, shareholders, wider society and the environment. Examples are poor employee relations, human rights abuses, failure to follow regulations, and pollution. Controversies help to indicate the quality of a company.

Corporate governance

The way that companies are organised and led. We look at how well companies are sticking to good practices set out in Corporate Governance Codes, which vary from country to country. Corporate governance is also part of the ‚G‘ in ESG. In this context Governance may focus on the operational and management practices relating to social and environment aspects of the business.

Corporate Social Responsibility (CSR)

A company’s approach to (and engagement with) its stakeholders and the communities it operates in, reflecting its responsibility towards people and planet.

D

Decarbonisation

The reduction of the carbon emissions associated with a region, country, industry or organisation. It can also refer to the reduction of the carbon emissions associated with a fund’s investments.

Divestment

The opposite of investment. In other words, either reducing or exiting an investment. We divest if we think the potential risks of investing in a company outweigh the potential returns. This may be because we have lost confidence in a company’s leadership, strategy, practices or prospects .

E

Engagement

Talking to members of the board or management of a company – a two-way process that we might initiate, or the company might initiate. We use engagement to understand companies better. We also use it to give feedback, offer advice and seek changes – including change relating to ESG and climate risk. Engagement also means consulting with government and collaborating with other investors to influence policy and shape debate.

Environmental

The „E“ in ESG. This covers a focus on significant environmental risks and their management. In a climate change context it is a focus on the risks associated with a business having to adapt to climate change requirements or the physical impacts of climate change. We also look at companies‘ environmental opportunities due to changing consumer demands, policy changes, technology and innovation.

ESG

Short for environmental, social and governance. Investors consider companies‘ ESG risks and how well they are managed. To do this, we use the Sustainability Accounting Standards Board (SASB) framework. Considering ESG gives us a different perspective on how good an investment might be.

ESG integration

Always taking account of ESG issues when assessing potential investment opportunities and monitoring the investments in a portfolio.

ESG ratings

Many investment managers use external providers, such as MSCI, to rate companies on their ESG practices. Each provider has its own way of doing things, so ESG scores can vary radically from one provider to another. We run our own ESG system to rate companies. This is based on 77 standards, each for a different industry, produced by the Sustainability Accounting Standards Board.

Ethical investing

An ethical approach excludes investments that conflict with the client values and ethics that a fund is seeking to reflect. There are many different activities or issues that people prioritise as ethical. Common examples include tobacco, adult entertainment, controversial weapons, coal or activities that contravene religious social teaching.

Exclusion

Excluding companies from a portfolio. Exclusions can also be used to set minimum standards or characteristics for inclusion of investments in portfolios. Fund managers may exclude entire industries (e.g. tobacco), companies involved in ethically questionable activities (e.g. gambling), companies that fail to meet certain ESG standards, and companies with a bad carbon intensity.

F

Fundamental analysis/research

Using research to work out the true value of an investment, rather than its current price. Many factors contribute to this, including responsible investment factors. Responsible investment helps us understand the quality of a company, its scope to develop and improve (e.g. in response to climate transition) and its prospects (through making money from responding to sustainability issues). Even if a company is good, it is unlikely to offer good investment returns if this is already reflected in the share price.

G

Green bonds

Debt issued by companies or governments, with the money raised earmarked for green initiatives such as building renewable energy facilities.

Greenwashing

Insincere approaches to climate change and other ESG issues by companies, including investment management firms. For example, an investment manager may label a fund as an ESG fund, even if it does not adopt ESG integration in practice.

I

Impact investing

International Labour Organisation (ILO)

A United Nations agency, often abbreviated to „ILO“, that sets international standards for fairness and safety at work. The ILO standards are commonly used by investors to assess how serious a corporate controversy is.

M

Materiality

An ESG issue is „material“ if it is likely to have a significant positive or negative effect on a company’s value or performance.

N

Norms-based screening

Screening investments for potential controversies by looking at whether a company follows recognised international standards. We consider standards including the International Labour Organisation standards, the UN Guiding Principles for Business and Human Rights and the UN Global Compact. Specialist RI funds may exclude companies that do not meet these standards.

P

Physical risk

The physical risks of climate change for businesses, such as rising sea levels, water shortages and changing weather patterns.

Portfolio tilts

Investment industry jargon for having more of something in a portfolio than the benchmark, or less of it. In responsible investment it usually means having more companies in a portfolio that have better ESG credentials or are less exposed to climate risk than there is in the benchmark. The tilt is measured as the overall exposure to a specific type of investment in a portfolio compared to that in the benchmark.

Positive inclusion/screening

Seeking companies that have good ESG practices or that help the world economy be more sustainable. Also used as an alternative to „best-in-class„. The opposite of exclusion.

Principles for Responsible Investment

Often shortened to PRI. A voluntary set of six ethical principles that many investment companies have agreed to adopt. Principle 1, for example, is: „We will incorporate ESG issues into investment analysis and decision-making processes.“ The PRI was sponsored by the United Nations. Columbia Threadneedle is a founding signatory, and has attained the top A+ headline rating for its overall approach for the sixth year running.

Proxy voting

Voting on behalf of our clients at company general meetings to show support of their practices and approach – or to show our dissent. We put our voting record on our website within seven days of the vote.

R

Responsible Investment (RI)

The umbrella term for our approach towards managing our clients‘ money responsibly. This includes the integration of ESG factors, controversies, sustainability opportunities and climate risks into our investment research and engagements with companies, to inform our investment decisions and proxy voting.

Responsible Investment Ratings

Mathematical models created by our responsible investment analysts that provide an evidence-based and forward-looking indication of the quality of a business and its management of risk.

S

Scope 1, 2 and 3 emissions

The building blocks used to measure the carbon emissions and carbon intensity of a company. Under an international framework called the Greenhouse Gas Protocol these are divided into Scope 1, 2 and 3 emissions. Scope 1 emissions are generated directly by the business (e.g. its facilities and vehicles). Scope 2 covers emissions caused by something a company uses (e.g. electricity). Scope 3 is the least reliable because it is the hardest to measure. It covers other indirect emissions generated by the products it produces (e.g. from people driving the cars a company makes).

Screened funds

Funds that use screens to exclude companies that do not meet their ethical criteria, ESG expectations, carbon intensity or controversy standards.

Social

The „S“ in ESG. Investors analyse social risks and how these are managed. This includes a company’s treatment of its employees and its human rights record for other people outside the company (e.g. in the supply chain). It also refers to a company’s commercial opportunities in responding to changing consumer demands, policy changes or technology and innovation (e.g housing, education or healthcare).

Social bonds

Bonds issued to raise money for a socially useful purpose, such as education or affordable housing. Social bonds follow the standards set by the International Capital Market Association (ICMA) and appoint independent external reviewers to confirm the money raised will be used appropriately.

Socially Responsible Investing (SRI)

A form of ethical investment that attaches particular importance to avoiding harm to people or the planet, from the investments being made.

Stewardship

A catch-all term to describe the actions taken to look after our clients‘ money. It commonly involves both engagement with companies, to develop a proper understanding of business developments, issues and potential concerns; and proxy voting to support or oppose issues at company general meetings.

Stranded assets

A variety of factors can lead to the risk of assets becoming stranded, such as new regulations or taxes (e.g. carbon taxes or changes in emission trading schemes) or changes in demand (e.g. impacts on fossil fuels, resulting from the shift towards renewable energy). Stranded assets risk having their value written down, impacting the value they have in a company’s accounts.

Sub-advisor

When one investment management company hires another investment management company to manage one of their funds, the hired company is the sub-advisor. Sub-advisors are sometimes used in responsible investment if they have specialist knowledge of this field that does not exist in-house.

Sustainability Accounting Standards Board

Often referred to as „SASB“, this is a non-profit organisation that sets standards for the sustainability information companies should communicate to their investors. It has produced 77 sets of industry-specific global standards. SASB looks for sustainability issues that are financially significant to a particular industry.

Sustainability risk

An environmental, social or governance risk that could hit the value of an investment.

Sustainable Development Goals (SDGs)

A set of 17 policy goals set out by the United Nations, which aim for prosperity for all without harming people and the planet. Each goal has a number of targets. For example, Goal 2 is Zero Hunger and Target 2.3 is to double the productivity and incomes of small-scale food producers. Companies can contribute to the SDGs by making products or services that help achieve at least one of the 17 goals.

Sustainable investing

Investing in a way that recognises the need for and supports balanced social, environmental and economic development for the long term.

T

Task Force on Climate-related Financial Disclosures (TCFD)

The Task Force on Climate-Related Financial Disclosures was set up by the World Bank to help companies communicate their climate risks and opportunities and how they manage them. The TFCD sets out a framework for communicating how management considers climate risks, its strategy for responding to climate change, risk management arrangements and the types of risk covered. The TCFD says companies should, for example, explain how their business strategies would cope in different temperature scenarios. From 2022 companies listed on the UK stock market will have to follow the TCFD’s recommendations for disclosing climate risks.

EU SFDR (Sustainable Finance Disclosure Regulation)

This forces funds to communicate how they integrate sustainability risk and consider adverse impacts. For funds promoting environmental or social characteristics or that are targeting sustainability objectives, additional information will need to be communicated.

The EU Taxonomy

Often called the „Green Taxonomy“. This is the EU’s system for deciding whether an investment is sustainable. Investments must contribute to one or more environmental objectives and meet the detailed criteria required for each activity or product that contributes to this. Investments must not do significant harm to any of the objectives. They must also meet minimum standards in business practices, labour standards, human rights, and governance.

Thematic investing

Researching global trends, or „themes“, to identify investments that will either benefit from changing needs or be impacted by them. Common themes are climate change and technological innovation. Often combined with sustainable investing, which looks at these trends but with an additional focus on the environmental or social implications of themes.

Transition risk

The potential risks faced by companies as society transitions towards alignment with the Paris Agreement to limit global warming. This is the risk that a company is so invested in certain incompatible operations and assets that it is uneconomical to transition to align with the Paris Agreement.

U

UN Global Compact (UNGC)

The world’s largest sustainability initiative. The UNGC sets out a framework based on Ten Principles for business strategies, policies and practices, designed to make businesses behave responsibly and with moral integrity. Companies can volunteer to sign the Compact, and can be struck off by the UN for breaking it. The Compact is commonly used by investors to assess how serious controversies are.

UN Guiding Principles for Business and Human Rights

A framework for companies to prevent human rights abuses caused by their activities. Commonly used by investors to assess the severity of companies‘ human rights failures.

COP29: Will it deliver on climate finance?

CT SDG Engagement Global Equity Strategy

Power hungry AI - investment implications in the era of energy transition

Wichtige information

Für Vermarktungszwecke. Ihr Kapital unterliegt einem Risiko. Columbia Threadneedle Investments ist der globale Markenname der Columbia- und Threadneedle-Unternehmensgruppe. Nicht alle Dienstleistungen, Produkte und Strategien werden von jedem Unternehmen der Gruppe angeboten. Auszeichnungen oder Ratings beziehen sich möglicherweise nicht auf alle Unternehmen der Gruppe.

Im Vereinigten Königreich: Herausgegeben von Threadneedle Asset Management Limited, Nr. 573204, und/oder Columbia Threadneedle Management Limited, Nr. 517895, jeweils eingetragen in England und Wales und von der Financial Conduct Authority im Vereinigten Königreich zugelassen und reguliert.

Im EWR: Herausgegeben von Threadneedle Management Luxembourg S.A., eingetragen im Registre de Commerce et des Sociétés (Luxembourg) unter der Nr. B 110242 und/oder Columbia Threadneedle Netherlands B.V., reguliert von der Autoriteit Financiële Markten (AFM), eingetragen unter der Nr. 08068841.

Im Nahen Osten: Dieses Dokument wird von Columbia Threadneedle Investments (ME) Limited verteilt, die von der Dubai Financial Services Authority (DFSA) reguliert wird. Für Vertriebsstellen: Dieses Dokument dient dazu, Vertriebsstellen Informationen über die Produkte und Dienstleistungen der Gruppe bereitzustellen, und ist nicht zur Weitergabe bestimmt. Für institutionelle Kunden: Die in diesem Dokument enthaltenen Informationen stellen keine Finanzberatung dar und sind ausschließlich für Personen mit entsprechenden Anlagekenntnissen bestimmt, welche die aufsichtsrechtlichen Kriterien für professionelle Anleger oder Marktkontrahenten erfüllen, und dürfen von keiner anderen Person als Entscheidungsgrundlage verwendet werden.

In Australien: Threadneedle Investments Singapore (Pte.) Limited [„TIS“], ARBN 600 027 414, und/oder Columbia Threadneedle EM Investments Australia Limited [„CTEM“], ARBN 651 237 044. TIS und CTEM sind von der Vorschrift befreit, eine australische Finanzdienstleisterlizenz gemäß dem Corporations Act zu besitzen, und stützen sich bei der Vermarktung und Erbringung von Finanzdienstleistungen für australische Wholesale-Kunden gemäß der Definition in Section 761G des Corporations Act 2001 auf Class Order 03/1102 bzw. 03/1099. TIS unterliegt in Singapur (Registrierungsnummer: 201101559W) der Bankenaufsicht der Monetary Authority of Singapore gemäß Securities and Futures Act (Chapter 289), der von australischem Recht abweicht. CTEM wurde von der Financial Conduct Authority zugelassen und unterliegt deren Aufsicht nach britischem Recht, das von australischem Recht abweicht.

In Singapur: Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapur 239519, reguliert in Singapur von der Monetary Authority of Singapore im Rahmen des Securities and Futures Act (Chapter 289). Registrierungsnummer: 201101559W. Dieses Dokument wurde nicht von der Monetary Authority of Singapore geprüft.

In Japan: Columbia Threadneedle Investments Japan Co., Ltd. Financial Instruments Business Operator, The Director-General of Kanto Local Finance Bureau (FIBO) Nr. 3281, und Mitglied der Japan Investment Advisers Association.

In Hongkong: Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司, Unit 3004, Two Exchange Square, 8 Connaught Place, Hongkong, von der Securities and Futures Commission („SFC“) für die Ausführung regulierter Tätigkeiten vom Typ 1 lizenziert (CE: AQA779). Eingetragen in Hongkong unter der Companies Ordinance (Chapter 622), Nr. 1173058, und/oder herausgegeben von Columbia Threadneedle AM (Asia) Limited, Unit 3004, Two Exchange Square, 8 Connaught Place, Central, Hongkong, von der Securities and Futures Commission („SFC“) für die Ausführung regulierter Tätigkeiten vom Typ 4 und Typ 9 lizenziert (CE: ABA410). Eingetragen in Hongkong unter der Companies Ordinance (Chapter 622), Nr. 14954504.